Sarah started educating herself on personal finance greatest methods through her early several years battling to seek out balance amid New York City’s significant cost of residing. The money administration abilities Sarah acquired in the course of her many years like a self-utilized freelance editor also honed her fiscal acumen, offering her a enthusiasm for supporting Some others navigate the fiscal difficulties of little business enterprise ownership, taxes, and budgeting. In her private life, Sarah enjoys encouraging her pals level up their credit card approaches to ebook fancy hotel rooms and flights. She also enjoys referring to her Pet dog to anybody who will listen.ExpertiseSarah’s spots of personal finance knowledge consist of:

Are there Applicable Charges? FinnFox services are furnished totally free to you. On the other hand, the lender you will be connected with will commonly charge you applicable fees and/or curiosity based on the lender and also the loan arrangement.

Be careful for: Substantial origination expenses. LendingPoint may cost you an nearly 8%, based on the state you live in.

OneMain Fiscal is a great option for emergency loans for negative credit history, since the lender has no least credit history rating demanded for acceptance. Borrowers with undesirable credit rating may very well be much more prone to qualify for just a loan with this organization than Yet another.

Credit card dollars progress: Sometimes you could possibly need a surge of money to buy an expenditure that will only be paid in income and wherever bank cards are not accepted. Several bank cards have a money advance attribute where you will take money from an ATM or lender. The amount you could borrow in the shape of the funds advance is predetermined and may be spelled out within the terms and conditions. Also, for those who study the stipulations, you can most likely discover that hard cash innovations feature a greater interest fee than your variable APR.

Possibly you've shed your work unexpectedly or are out of the blue struggling with a major medical expenditure not paid out for by insurance policies. Personalized loans, specially unexpected emergency loans, can assist you get back on the toes and cover a set you back hadn't planned for within your spending budget.

This will likely be a fast approach, so you'll want to do this with a number of lenders for anyone who is shopping for an crisis loan. Prequalification doesn't influence your credit score.

You're able to enlist a cosigner to qualify for a loan you if not wouldn't have or to obtain a decreased rate.

Emergency loans are own loans You can utilize for unanticipated situations and fees, like a work loss or a costly medical Monthly bill. If you don't have an unexpected emergency fund, You should utilize these loans to receive unexpected emergency income to protect the cost of your price and provide by yourself breathing home.

It is best to prevent these loans completely if at all possible because They can be costly, the lender calls for usage of your banking account, and these loans can put the borrower right into a cycle of personal debt.

You are able to enlist a cosigner to qualify for any loan you if not would not have or to secure a reduce charge.

OneMain Economic Private Loan disclosure: Not all applicants is going to be authorized. Loan approval and actual loan conditions rely upon your capacity to meet up with our credit score specifications (which includes a responsible credit rating record, enough profits immediately after regular monthly expenditures, and availability of collateral) plus your condition of residence. If authorised, not all applicants will qualify for larger sized loan amounts or most favorable loan terms. Greater loan amounts need a 1st lien on a motorized vehicle no more than 10 many years previous, that satisfies our worth specifications, titled in the title with legitimate coverage. APRs are commonly higher on loans not secured by a motor vehicle. Highly-experienced applicants may very well be made available larger loan quantities and/or reduce APRs than those demonstrated above. OneMain prices origination fees the place authorized by regulation. According to the state where you open more info your loan, the origination rate could be either a flat volume or perhaps a proportion of your respective loan amount. Flat charge amounts range by point out, starting from $25 to $500. Percentage-based charges range by point out starting from one% to ten% of your loan sum matter to selected state limitations to the payment quantity. Pay a visit to omf.com/loanfees To learn more.

That currently being mentioned, among the main upsides of getting a money advance from your current charge card limit is The reality that you don't need to undergo a completely new credit score Look at. As a result, no tricky inquiry in your credit rating report. Additionally, In case you have negative credit rating plus your likelihood of qualifying for a private loan are questionable, you can obtain a cash advance out of your current bank card conveniently because you are currently competent in your full credit limit.

We charge all own loan goods within our evaluations and guides with a one-five scale. The general score is actually a weighted average factoring in seven distinctive classes, which includes curiosity prices and costs (weighted the most heavily) and purchaser guidance and ethics (weighted fewer seriously).

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Alisan Porter Then & Now!

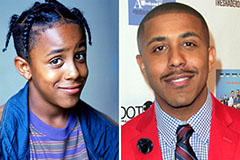

Alisan Porter Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!